oniongate.online Community

Community

Home Depot Credit Card Customer Service Number

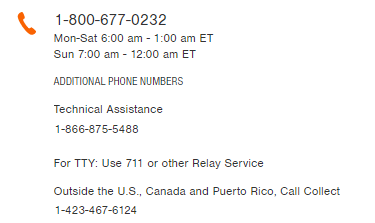

Automated Customer Service is available after business hours. Additional Phone Numbers. Technical Assistance. Bell Relay for the Hearing. Best chance is calling the number on the back of the card. Stores have little to no involvement in the credit side of things. Technical Assistance. · For TTY: Use or other Relay Service · Outside the U.S., Canada and Puerto Rico, Call Collect. For Store Related Issues and Questions: Please call us at HomeDepot to speak directly with a Customer Care Store Specialist about your issue or send. credit cards primarily tailored for Home Depot's customers to finance their home improvement projects. Phone Numbers. Support Phone. · Contact. If you are having trouble locating a product online, please call our oniongate.online Customer Care Team at for assistance. What credit cards are. Credit Card Services - The Home Depot · Pay and Manage Card · · Card FAQs. Just call the number on the back of your credit card. Say 'representative' to access fast, live help from a friendly Customer Service representative ready to. Manage your Home Depot credit card account online, any time, using any device. Submit an application for a Home Depot credit card now. Automated Customer Service is available after business hours. Additional Phone Numbers. Technical Assistance. Bell Relay for the Hearing. Best chance is calling the number on the back of the card. Stores have little to no involvement in the credit side of things. Technical Assistance. · For TTY: Use or other Relay Service · Outside the U.S., Canada and Puerto Rico, Call Collect. For Store Related Issues and Questions: Please call us at HomeDepot to speak directly with a Customer Care Store Specialist about your issue or send. credit cards primarily tailored for Home Depot's customers to finance their home improvement projects. Phone Numbers. Support Phone. · Contact. If you are having trouble locating a product online, please call our oniongate.online Customer Care Team at for assistance. What credit cards are. Credit Card Services - The Home Depot · Pay and Manage Card · · Card FAQs. Just call the number on the back of your credit card. Say 'representative' to access fast, live help from a friendly Customer Service representative ready to. Manage your Home Depot credit card account online, any time, using any device. Submit an application for a Home Depot credit card now.

For questions related to your The Home Depot Commercial Credit Card, please call Citibank, N.A. at and a Citi Representative will be happy to. Can't find what you're looking for? Call our general help line at HOME-DEPOT (). View Our Directory For More Numbers. Pay your Wells Fargo Bank, N.A. credit card bill online, review your statement guide, find answers to your questions, or locate your credit card account. If you misplaced your Gift Card or if your Gift Card was lost or stolen, contact Customer Care immediately at HOME-DEPOT (). If your Gift. Credit Card Services Support. Consumer Credit Card Project Loan Pro Xtra Credit Card Commercial Account 8am - 1 am (ET). Contact Form: Name: Email: Telephone: Question/comment: Home Depot Loan Services Customer Support. •, Application Process. •, Make a Payment. •. Home Depot Credit operates the call center for this phone number 24 hours, 7 days. The short answer is that you should call on a Thursday. This. What is the customer service phone number for Home Depot credit card? The Home Depot credit card customer service number is () What is the. Fortiva® Credit Card Telecommunications Relay Service for TTY/TDD hearing impaired: Call and then for Fortiva® customers. Customer Questions Click here or call HOME-DEPOT () Applicant Questions For questions from oniongate.online A Customer Service Representative will report your card as lost or Include a note with the credit card account number to be credited, and keep. To schedule a payment, visit our Credit Card Services page, then select “Pay Each listing will include the store address, phone number, hours. Contact Us · Who do I call if I have questions about my account? You can reach Citi Cards Canada Inc. at , TTY: Use or other Relay Service. For faster service, please chat or text us. Consumer Credit Card: , TTY: Use or other Relay Service. Commercial Credit Card: The payment cutoff time for Online Bill and Phone Payments is midnight ET. This means we will credit your account as of the calendar day, based on Eastern Time. Enter your Synchrony HOME Credit Card account number when prompted. Will How can I contact customer service for the Synchrony HOME Credit Card? You. Contact Home Depot customer service for your customer service needs. Reach out via phone, email, or social media. Make a free Phone Payment by calling Make a Payment by Regular US Mail: Dept # Home Depot Loan Services PO Box Charlotte, NC If you wish to link additional The Home Depot Commercial Credit Card accounts to your existing Fuel Rewards® account, please call Citibank, N.A. customer.

Pre Approved Bank Account

Pre-qualification does not guarantee account approval and you must submit a full application for review in order to apply for any pre-qualified offer(s) of. “Pre-approved” is a scam. It means about the same thing as “NOT approved YET'. You won't be approved until you apply. Pre-approval is the next stage after pre-qualification. Basically, becoming pre-approved for a loan means you have undergone further vetting and are confirmed. Mortgage pre-approval, also sometimes referred to as mortgage pre-qualification, signals to realtors, builders and sellers that you're a serious buyer. It also. Pre Approved Loan: Get instant approval in 5 mins for your pre-approved personal loan to fulfil your personal needs from ICICI Bank. Avail pre-approved loan. We take pride in helping qualified home buyers finance their dream home. Gain a competitive advantage in the home-buying process. A mortgage pre-approval. Both pre-qualified and pre-approved mean that a lender has reviewed your financial situation and determined that you meet at least some of their. Prequalified and Preapproved are both terms used by issuers to suggest you have met criteria established in advance. If you've received a pre-approval offer. Discover Credit Card Pre-Approval Form. See if you're pre-approved with no impact to your credit score. It's fast and secure. Pre-qualification does not guarantee account approval and you must submit a full application for review in order to apply for any pre-qualified offer(s) of. “Pre-approved” is a scam. It means about the same thing as “NOT approved YET'. You won't be approved until you apply. Pre-approval is the next stage after pre-qualification. Basically, becoming pre-approved for a loan means you have undergone further vetting and are confirmed. Mortgage pre-approval, also sometimes referred to as mortgage pre-qualification, signals to realtors, builders and sellers that you're a serious buyer. It also. Pre Approved Loan: Get instant approval in 5 mins for your pre-approved personal loan to fulfil your personal needs from ICICI Bank. Avail pre-approved loan. We take pride in helping qualified home buyers finance their dream home. Gain a competitive advantage in the home-buying process. A mortgage pre-approval. Both pre-qualified and pre-approved mean that a lender has reviewed your financial situation and determined that you meet at least some of their. Prequalified and Preapproved are both terms used by issuers to suggest you have met criteria established in advance. If you've received a pre-approval offer. Discover Credit Card Pre-Approval Form. See if you're pre-approved with no impact to your credit score. It's fast and secure.

You can access your preferences as well as cookie and details about our partners at any time on the Application Home Page by clicking Your Privacy Choices. Becoming pre-qualified is the initial step in the mortgage process and involves providing a potential mortgage lender with an overall picture of your debts. Any lending institution that handles mortgages should be able to provide pre-approval. That includes banks, credit unions and the growing industry of online. Get instant pre approved personal loan online from Bank of Baroda and meet your urgent financial needs. Find out more about pre approved loans & apply. Before preapproving you for a loan, lenders typically check your credit and will ask to see your most recent tax returns, pay stubs and bank account statements. The pre-approval meeting is the time to find out about different mortgage products that are available to suit your particular needs. Once the mortgage is pre-. Capital Bank Home Loans helps make it easy to apply for a mortgage pre-approval whether you're in the market for your first home, a family that's outgrown your. Now that I'm conditionally approved, I need the funds in my bank You don't need it in your bank account for pre approval. But they. In fact, you are under no obligation to borrow money and there is no cost for a pre-approval. You are simply allowing our Mortgage Specialist to go through the. Low Processing Fees · Instant Loan Processing & Disbursement in just 4 clicks · No physical documentation · 24*7 availability through YONO & Internet Banking · No. Our PAL is a personal line of credit that provides overdraft protection for your checking account, as well as a pre-approved credit line whenever you need it. If you decide to change bank accounts between pre-approval and closing, you will have to repeat the lengthy process, delaying your final approval for the. Getting pre-approved or pre-qualified for a credit card typically means that your credit profile might match the general requirements to become a cardholder. Find out how to get pre-approved for a mortgage. Apply Online, Contact a Loan Officer. With a North Shore Bank pre-approval, you can make an offer on a new. To enhance your account security, you may be asked to enter a verification code for some online transactions when using your Bangor Savings Bank debit or credit. When you get pre-approved, on the other hand, the lender is giving you approval for a specific loan amount under certain conditions. You'll give your lender. Apply online. Banking Accounts. Bank for free with Unfee. Not a member yet? Apply online. Credit Cards. We have a Cambrian Mastercard® for you, whether. If you have bills paid automatically paid out of your checking account or by credit card, by all means, continue to do so. Your pre-approval only relates to a. By submitting a pre-approval request, you grant your permission to be evaluated for multiple Petal credit cards. Pre-approval does not guarantee an account. Pre-authorized payments are arrangements you make with a creditor or merchant to automatically withdraw funds from your account on a regular basis.

How To Sell A Financed Vehicle To A Private Party

If you're underwater on your loan, a private sale is going to be tricky. Many potential buyers won't like the fact that you don't have the title. The payment. Selling your car to a private owner means you'll need to know how to negotiate the price. Always let the buyer take the lead in any negotiations. If you've. Selling a Car with a Loan in Missouri · 1. Contacting Your Lender to Determine the Payoff Amount · 2. Evaluating Your Car's Value · 3. Transferring Ownership and. How does trading in a car with a loan work? · Find your loan balance: Determine how much you owe on your current financed vehicle. · Estimate your trade-in value. Else if you are selling to a private party, you must pay the loan balance yourself. If you have good credit, you might utilize a personal loan to pay off the. Dealerships acquire used cars from many sources aside from trade-ins, including auctions, car rental agencies, and private parties. Thinking about trading in. Pre-qualify for a car loan with no credit score impact A bill of sale for a private party vehicle transfer does not need to be notarized in New York. 1. Check to see if there are liens on your vehicle · 2. Determine how much you need to pay off your loan · 3. Sell your vehicle to a dealership or a private party. The first thing you can do if you're selling a car that still has a loan on it is to ask your lender for more information about selling the car. If you're underwater on your loan, a private sale is going to be tricky. Many potential buyers won't like the fact that you don't have the title. The payment. Selling your car to a private owner means you'll need to know how to negotiate the price. Always let the buyer take the lead in any negotiations. If you've. Selling a Car with a Loan in Missouri · 1. Contacting Your Lender to Determine the Payoff Amount · 2. Evaluating Your Car's Value · 3. Transferring Ownership and. How does trading in a car with a loan work? · Find your loan balance: Determine how much you owe on your current financed vehicle. · Estimate your trade-in value. Else if you are selling to a private party, you must pay the loan balance yourself. If you have good credit, you might utilize a personal loan to pay off the. Dealerships acquire used cars from many sources aside from trade-ins, including auctions, car rental agencies, and private parties. Thinking about trading in. Pre-qualify for a car loan with no credit score impact A bill of sale for a private party vehicle transfer does not need to be notarized in New York. 1. Check to see if there are liens on your vehicle · 2. Determine how much you need to pay off your loan · 3. Sell your vehicle to a dealership or a private party. The first thing you can do if you're selling a car that still has a loan on it is to ask your lender for more information about selling the car.

If you are selling your car, we recommend the seller pays with cash or wire the money to receive either the title or a lien release immediately. Call your lender to determine the exact amount owed on your vehicle. At the same time, we can obtain a lien release, which states that there are no outstanding. Selling privately means you advertise the car for sale and sell it to an individual, rather than selling to a dealership or car-buying service. Instant Cash. Learn how to transfer a title when buying or selling a vehicle from a dealer or private party, or receiving it as a gift or inheritance, and how to report a. Step One: Know What Your Car Is Worth · Step Two: Learn Your Payoff Amount · Step Three: Determine Your Equity · Step Four: Sell to a Private Party or Dealer · Step. way to sell their used cars or use a trade-in car deal. Not everyone has the time or desire to become a private party seller — and that's where Bellamy. If you are persistent on selling to a private party, it is important to be as upfront as possible, and have all of the details on the loan available from the. Private sellers typically don't offer financing, so you may need to take out a loan unless you have enough cash to pay for the car upfront. Either way, when. Yes, you can borrow money from a financial institution to buy a car from a private seller. This type of financing means that if you're selling your car, you. How To Sell Your Vehicle Privately With a Loan · Gather relevant information and forms · Calculate your equity · Find out your loan payoff amount · Contact your. You can sell your car if you still have an outstanding loan balance on it, but you may not get enough money to pay back the loan in full. · Talk to your lender. You can sell anywhere, even private party. It is a little more of a hassle to sell private party, but it's usually worth it because you get more. In a private sale, the lender must receive the payoff amount in full before the loan officer can sign over the title to the buyer. If you have positive equity. Yes, you can sell a financed car, but if you plan to sell privately, you need to figure out how to pay off the remaining loan balance before transferring. Steps to sell your financed vehicle to a dealership · 1. · Contact the bank you have the loan from and get a payoff amount. Typically, the payoff amount is valid. If the seller is transferring ownership of a vehicle titled in Maryland and has financed the vehicle, a “Notice of Security Interest Filing” will be needed. If. The seller must complete the Transfer of Title by Seller section on the front of the title certificate including, the name and address of the buyer, the. You can make more money by choosing to sell privately. However, selling your car to a private party isn't quite as straightforward as selling to a dealer. That. Under The Hood · Log into your Swap Motors account and check your desired vehicle's CARFAX Vehicle History report for an outstanding loan · Discuss Results of.

How Much Is Oil Trading For

Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Commodity Prices. The following graphs present commodity future prices over the periods of the last week, last three months and last year. All changes are. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes. How to trade crude oil futures. Crude oil futures, E-mini crude oil futures and Micro WTI crude oil futures can be traded nearly 24 hours a day. Get the latest US Crude Oil Spot prices in realtime including live charts, historical data, news and analysis. Follow live Oil - Crude price and trace the. Price of oil · The price of oil, or the oil price, generally refers to the spot price · The global price of crude oil was relatively consistent in the. Offers over crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools and smart analytical features. Our diverse WTI futures and options suite provides more flexibility to trade oil with WTI Crude Oil price discovery. View delayed WTI Oil prices and WTI Oil. Global oil markets. Global oil prices and inventories. The Brent crude oil spot price averaged $85 per barrel (b) in July, up $3/b from the average in June. Crude Oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Commodity Prices. The following graphs present commodity future prices over the periods of the last week, last three months and last year. All changes are. Oil Price: Get all information on the Price of Oil including News, Charts and Realtime Quotes. How to trade crude oil futures. Crude oil futures, E-mini crude oil futures and Micro WTI crude oil futures can be traded nearly 24 hours a day. Get the latest US Crude Oil Spot prices in realtime including live charts, historical data, news and analysis. Follow live Oil - Crude price and trace the. Price of oil · The price of oil, or the oil price, generally refers to the spot price · The global price of crude oil was relatively consistent in the. Offers over crude oil blends and indexes from all around the world, providing users with oil price charts, comparison tools and smart analytical features. Our diverse WTI futures and options suite provides more flexibility to trade oil with WTI Crude Oil price discovery. View delayed WTI Oil prices and WTI Oil. Global oil markets. Global oil prices and inventories. The Brent crude oil spot price averaged $85 per barrel (b) in July, up $3/b from the average in June.

View the daily price of the crude stream traded at Cushing, Oklahoma, which is used as a benchmark in oil pricing. Explore real-time Crude Oil futures price data and key metrics crucial for understanding and navigating the Crude Oil Futures market. Also, Friday's action by Saudi Arabia to cut crude prices to Asian customers for October delivery signals weak demand and was negative for oil prices. Friday's. stock trading and investing Oil prices slump. Get the latest Crude Oil price (CL:NMX) as well as the latest futures prices and other commodity market news at Nasdaq. Heating Oil decreased USD/GAL or % since the beginning of , according to trading on a contract for difference (CFD) that tracks the benchmark. Platts connects & explains the market price of crude oil and oil products. Discover how you can access our oil prices, news, and analysis. Get WTI Crude (Oct'24) (@CLNew York Mercantile Exchange) real-time stock quotes, news, price and financial information from CNBC. WTI and Brent trade in $US per barrel (42 US gallons/ litres) and have excellent market transparency. The two benchmark prices are highly correlated and. Crude Oil · Open. · Previous Close. · Day High. · Day Low. · 52 Week High. · 52 Week Low. Today's live Brent crude oil spot price is at $ per barrel. That's down % from last week's price of $ per barrel. Brent crude oil trades six days. Brent crude oil is expected to trade at USD/BBL by the end of this quarter, according to Trading Economics global macro models and analysts expectations. Although we expect crude oil prices to rise in the coming months, our forecast for the annual average Brent crude oil price in is down from a forecast of. The current price of Light Crude Oil Futures is USD / BLL — it has risen % in the past 24 hours. Watch Light Crude Oil Futures price in more detail on. Live interactive chart of West Texas Intermediate (WTI or NYMEX) crude oil prices per barrel. More In Oil Prices and News ; Energy · OPEC+ members delay plans to hike production by two months after oil price slump ; Oil Prices and News · U.S. crude oil. U.S. Crude Oil Stocks Fall Less Than Expected. load Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. CRUDEOIL News. Oil prices slow sell-off as expectations of Fed rate cut grow · Learn with ETMarkets: How to trade crude oil futures using moving averages. The mere belief that oil demand will increase dramatically at some point in the future can result in a dramatic increase in oil prices in the present. WTI Crude Oil Futures · % change+% · Price ($/barrel)(dollars per barrel) · Change+

What To Upgrade Before Selling Your Home

It's almost certainly not worth it to do them yourself, unless you're in a real big hurry. · You may want to price it as if the work were done. The same holds true for the bathrooms, especially the master bath. A sparkling master bath with clean lines will charm open-house-goers with modern upgrades. 5 Improvements Every House Needs Before Listing · 1. Add a fresh coat of paint · 2. Use consistent flooring to bring spaces together · 3. Update the kitchen · 4. It only makes sense to renovate before selling if you're likely to add value to the home, making the property more competitive on the market and selling faster. Projects That Boost Your Home's Value · 1. Remodel the kitchen. · 2. Upgrade the appliances. · 3. Boost the bathrooms. · 4. Remodel the attic or basement. · 5. Get. Some of those fixes include painting, grouting tiles, and fixing broken fencing. The best home improvements to make before selling can help make your home look. 10 quick wins for adding value before selling · 1. Redecorate · 2. Fix superficial defects · 3. The front door · 4. Declutter · 5. Heating and lighting · 6. Garden. Renovations that are worth doing before you sell a home include a full kitchen remodel, full bathroom remodels, and simple landscaping. You can also increase. Sticking to traditional colors and furniture styles for staging is the safest bet to improve the resale of your home. Here are some painting tips to check out. It's almost certainly not worth it to do them yourself, unless you're in a real big hurry. · You may want to price it as if the work were done. The same holds true for the bathrooms, especially the master bath. A sparkling master bath with clean lines will charm open-house-goers with modern upgrades. 5 Improvements Every House Needs Before Listing · 1. Add a fresh coat of paint · 2. Use consistent flooring to bring spaces together · 3. Update the kitchen · 4. It only makes sense to renovate before selling if you're likely to add value to the home, making the property more competitive on the market and selling faster. Projects That Boost Your Home's Value · 1. Remodel the kitchen. · 2. Upgrade the appliances. · 3. Boost the bathrooms. · 4. Remodel the attic or basement. · 5. Get. Some of those fixes include painting, grouting tiles, and fixing broken fencing. The best home improvements to make before selling can help make your home look. 10 quick wins for adding value before selling · 1. Redecorate · 2. Fix superficial defects · 3. The front door · 4. Declutter · 5. Heating and lighting · 6. Garden. Renovations that are worth doing before you sell a home include a full kitchen remodel, full bathroom remodels, and simple landscaping. You can also increase. Sticking to traditional colors and furniture styles for staging is the safest bet to improve the resale of your home. Here are some painting tips to check out.

You want a clean, bright kitchen with updated appliances, updated fittings such as door handles and faucets for the sink. Upgrades can be completed within. A lower-level family room, home office, an extra bedroom or bathroom in the basement can all give your listing a significant boost at the offer table. #6. This strategy involves inspecting the property thoroughly, identifying any significant problems, and undertaking necessary renovations. By repairing critical. Almost any home will sell, but the trick is selling it for the price you want. If a home sale is on the horizon, you may be wondering if “upgrade kitchen”. Paint or Replace Garage Door The garage door occupies a significant portion of a home's front view, making it a crucial aspect to consider for an upgrade. A. When potential buyers are walking through your home, smell is something that can make them turn on their heels and walk right out of your home. Mold, mildew. It only makes sense to renovate before selling if you're likely to add value to the home, making the property more competitive on the market and selling faster. One of the best home improvements to make before selling is laying down a fresh coat of paint. Repainting your home — interior or exterior — can be one. If your home has ugly or broken blinds, you may feel the need to replace them. Instead of spending money on new blinds, just take them down. No buyer is going. 11 Home Updates That Consider Cost and Scale · Paint · Backsplash · Windows · Cabinets · Bathroom · Siding · Functioning Fireplace · Energy-Saving Thermostat. Personalized or High-End Upgrades · Buying expensive appliances: It is inadvisable to update appliances before a sale. · Adding wallpaper: Don't bother replacing. Paint makes a home look larger and well maintained. · Paint the front door. Think of your front door as the cheery welcome every buyer sees – after the. Electrical upgrades are a very efficient and effective way to make your home sell faster and sell higher at the same time. Partial Room Upgrades It's never a good idea to start an upgrade or remodel that you can't finish before you sell your house. Buyers can't always visualize. 12 Things to Do Before Selling Your House · 1. Find the right real estate agent · 2. Consider your curb appeal · 3. Declutter living areas · 4. Depersonalize your. Scratched-up wood flooring; ratty, outdated carpeting; and tired linoleum make your home feel sad. Buyers might take one step inside and scratch the property. Another part of the home that many people spend time in is the bathroom. Making sure that the bathroom is up-to-date is crucial when selling a home. You also. What's your budget to prepare your house for sale? This is a huge factor. You want to maximize your return on investment. For example, if you have $ to. We are currently working on preparing our former first-home-turned-rental-house to sell. upgrades to Kitchen and Bathrooms upfront before putting the house on. Almost any home will sell, but the trick is selling it for the price you want. If a home sale is on the horizon, you may be wondering if “upgrade kitchen”.

Exxon Smart Card Review

The Exxon Mobil Smart Card+ is a credit card for those who frequently purchase fuel and other items at Exxon Mobil stations. Make fuel theft and overspending a thing of the past with a fuel card proven to reduce customer fuel bills by an average of 10%¹. Our modern software makes. The Exxon Mobil Smart Card+™ helps you save on gas, in-store purchases and car washes at Exxon and Mobil stations. Check out what each card offers with our gas card comparison chart. Compare Cards · Fleet Smarthub. Simple, mobile account management. The app is great when it works. I m going on 2 months of intermittent use. First I was only able to use it the 1st time using the Exon smart card for payment. Double benefit, getting rewards points while buying these cards, along with filling Gas always in Cash Price. No Extra charge for paying via Credit Card:). The Exxon Mobil Smart Card+™ gas credit card is better than ever. Don't miss out on getting bigger gas savings at the pump and even more savings on the snacks. The app is great when it works. I m going on 2 months of intermittent use. First I was only able to use it the 1st time using the Exon smart card for payment. Pros & Cons of Exxon credit card · No annual fee. · Cardholders can earn rewards on their purchases. · Exxon Mobil Smart Card+ reports to multiple credit bureaus. The Exxon Mobil Smart Card+ is a credit card for those who frequently purchase fuel and other items at Exxon Mobil stations. Make fuel theft and overspending a thing of the past with a fuel card proven to reduce customer fuel bills by an average of 10%¹. Our modern software makes. The Exxon Mobil Smart Card+™ helps you save on gas, in-store purchases and car washes at Exxon and Mobil stations. Check out what each card offers with our gas card comparison chart. Compare Cards · Fleet Smarthub. Simple, mobile account management. The app is great when it works. I m going on 2 months of intermittent use. First I was only able to use it the 1st time using the Exon smart card for payment. Double benefit, getting rewards points while buying these cards, along with filling Gas always in Cash Price. No Extra charge for paying via Credit Card:). The Exxon Mobil Smart Card+™ gas credit card is better than ever. Don't miss out on getting bigger gas savings at the pump and even more savings on the snacks. The app is great when it works. I m going on 2 months of intermittent use. First I was only able to use it the 1st time using the Exon smart card for payment. Pros & Cons of Exxon credit card · No annual fee. · Cardholders can earn rewards on their purchases. · Exxon Mobil Smart Card+ reports to multiple credit bureaus.

The Exxon Mobil Rewards+ app accepts all major credit cards, Exxon Mobil Personal Cards, Exxon Mobil Smart Card+™, Exxon Mobil Direct Debit+™ (ACH debit payment). The ExxonMobil Smart Card offers 25 cents off per gallon of Synergy gas bought at ExxonMobil for your first two months of card membership. After that, you'll. smart tools (not clear which tools deals apply for). Save up to But a NO for owner-operators. Read Full Exxon Mobil Business Fleet Fuel Card Review >>. You can apply for the ExxonMobil Gas Card either through the dedicated application webpage or through the Exxon Mobil Rewards+ app for iOS or Android. The AAA card is going to give you 5% cash back no matter what gas station you use and Commentity (who issues the card) is usually very generous. Why should I use a gas card such as the Techron Advantage Card instead of a debit card? Exxon Mobil Smart Card: What You Need to Know. UPDATE: Some offers mentioned Best Buy Credit Card Review. UPDATE: Some offers mentioned below have. Exxon Mobil Rewards+ points will not be earned on purchases made with the Exxon Mobil Smart Card+™ credit card or with Exxon Mobil Direct Debit+™. Please be. Maximize your savings at the gas pump. Get matched to gas rewards credit cards from our partners based on your unique credit profile. You will receive statement credits based upon fuel purchases made with your ExxonMobil Smart Card at. Exxon and Mobil locations within the United States. You. Great card to have when traveling! The is an Exxon at almost every exit on the highway. Most have nice places for food & coffee. Usually hot good also. $0 fraud liability on unauthorized charges and online account management to review charges and make or schedule payments. You'll also get Grocery Rewards. Exxon Mobil BusinessPro™ card · Save with fuel rebates up to 6¢ per gallon†† on Synergy™ fuels, plus drivers earn points with the Exxon Mobil Rewards+ program. The Exxon Mobil BusinessPro card issuer intends to approve all applications within 48 hours from receipt of a completed application. You also take a cash advance if you make a wire transfer; buy a money order, traveler's check, lottery ticket, casino chip, or similar item; or engage in a. This card does not charge an annual fee, which makes it a smart choice for consumers looking for a low-cost card. There is a late fee starting at $ What. Smart list · Surfaced Item · Surfaced item overlay · Table. Complex components Map review · OEM · Product selector · Screen title · Social feed and share. A closer look at the best gas credit cards for fair credit: · Capital One QuicksilverOne Cash Rewards Credit Card · Exxon Mobil Smart Card+ · Sunoco Rewards Credit. Download the Exxon Mobil Rewards+ app today and earn $1 in savings (awarded in points) after your first purchase with the app! Similar to an Exxon Mobil Smart Card, safeguarding your budget is one of our main priorities. You have multiple options to choose from when it comes to your.

Clover Vs Square For Restaurants

Clover wins this round. Although Clover's upfront costs can be higher than Square's, Clover delivers industry-specific necessities and takes the guesswork out. Compare Clover vs. Lightspeed Retail vs. Square for Restaurants using this comparison chart. Compare price, features, and reviews of the software. Square requires users to process payments using its system, while Clover is a standalone POS system that can be used with various credit card processing. For more complex operations, Clover or Toast could offer the necessary features. Customization: If you want tailored solutions and versatile. Clover Point-of-Sale Payment Processing · –% + $ for in-person transactions · % + $ for card-not-present transactions. The short answer: If you get your clover from a reputable agent, clover beats square in almost every category. The long answer? Depends on lots. However, our research suggests that Square's retail features are slightly stronger overall, with the provider scoring a 4/5 in the category compared to Clover's. Square is suitable for small businesses where the transactions do not involve any complex processes when comparing the two. In contrast, bigger businesses can. Comparing Clover and Square for Restaurants customers based on their geographic location, we can see that Clover has more customers in United States, Canada and. Clover wins this round. Although Clover's upfront costs can be higher than Square's, Clover delivers industry-specific necessities and takes the guesswork out. Compare Clover vs. Lightspeed Retail vs. Square for Restaurants using this comparison chart. Compare price, features, and reviews of the software. Square requires users to process payments using its system, while Clover is a standalone POS system that can be used with various credit card processing. For more complex operations, Clover or Toast could offer the necessary features. Customization: If you want tailored solutions and versatile. Clover Point-of-Sale Payment Processing · –% + $ for in-person transactions · % + $ for card-not-present transactions. The short answer: If you get your clover from a reputable agent, clover beats square in almost every category. The long answer? Depends on lots. However, our research suggests that Square's retail features are slightly stronger overall, with the provider scoring a 4/5 in the category compared to Clover's. Square is suitable for small businesses where the transactions do not involve any complex processes when comparing the two. In contrast, bigger businesses can. Comparing Clover and Square for Restaurants customers based on their geographic location, we can see that Clover has more customers in United States, Canada and.

Our free tool can help you get a quick and detailed side-by-side comparison for Clover vs Square for Restaurants. Learn more about each of these software. Clover POS vs. Square POS: The Verdict. The bottom line is Square is cheaper to get started with, while Clover offers a more complete and robust POS solution. According to G2's research, Toast POS is the best Clover alternative. Toast is an all-in-one POS platform and software system built specifically for restaurants. The top three of Clover's competitors in the POS Systems category are Square with %, Toast with %, Lightspeed with % market share. Clover vs. Cost Effectiveness · For Square, the in-person transaction costs include % plus ten cents, while the in-person transaction costs for Clover are % plus ten. If you're a restaurant owner or manager who already uses restaurant management software such as Micros, Aloha, SumUp, Epos Now, Clover, Lightspeed or other POS. Compare Clover vs Square for Retail for Irish businesses. GetApp provides a side-by-side comparison with details on software price, features and reviews. Toast is rated at and is also an excellent choice for businesses that depend on detailed and granular outputs. Square offers features designed to handle. The downsides? Clover doesn't handle larger-scale retail shops or restaurants well, and the basic Clover POS software doesn't cut it compared to other POS. Clover has just the right combination of affordability with extra features and flexibility that isn't offered by some cheaper options. Clover is flexible enough. Winner: Clover Go, narrowly. You can take all three major payment methods (magstripe, chip, and contactless) with Square, but you'll need two devices to do so. In addition, Square offers paid plans with features that are tailored to specific industries, Square for Retail, Square for Restaurants (for casual and full-. Top 4 Reasons To Choose Truffle Systems Over Clover and Square · More than just a POS · Future proof your restaurant · Cross-platform compatibility · Restaurants. Compare Clover vs Square for Restaurants for South African businesses. GetApp provides a side-by-side comparison with details on software price. Clover. + users. Clover serves small to mid-sized businesses, including but not limited to quick-service restaurants, full-service restaurants, boutique. One of the biggest differences between Clover & Square is that you must process transactions with Square in order to use their hardware. On the contrary, Clover. Perhaps the biggest difference between the two restaurant POS systems is the operating systems. The TouchBistro POS solution runs on the Apple iOS, and the. Restaurant POS; eCommerce Management; Commission Management; Electronic Payments; Employee Management; Multi-Location; Inventory Management; Retail POS. Clover vs Square Point of Sale When assessing the two solutions, reviewers found Square Point of Sale easier to use, set up, and administer. Reviewers also. Square vs. Clover is a three-way POS dance for the ages, but research reveals that Square POS comes out on top thanks to its high-end features.

Long Term Care Insurance Examples

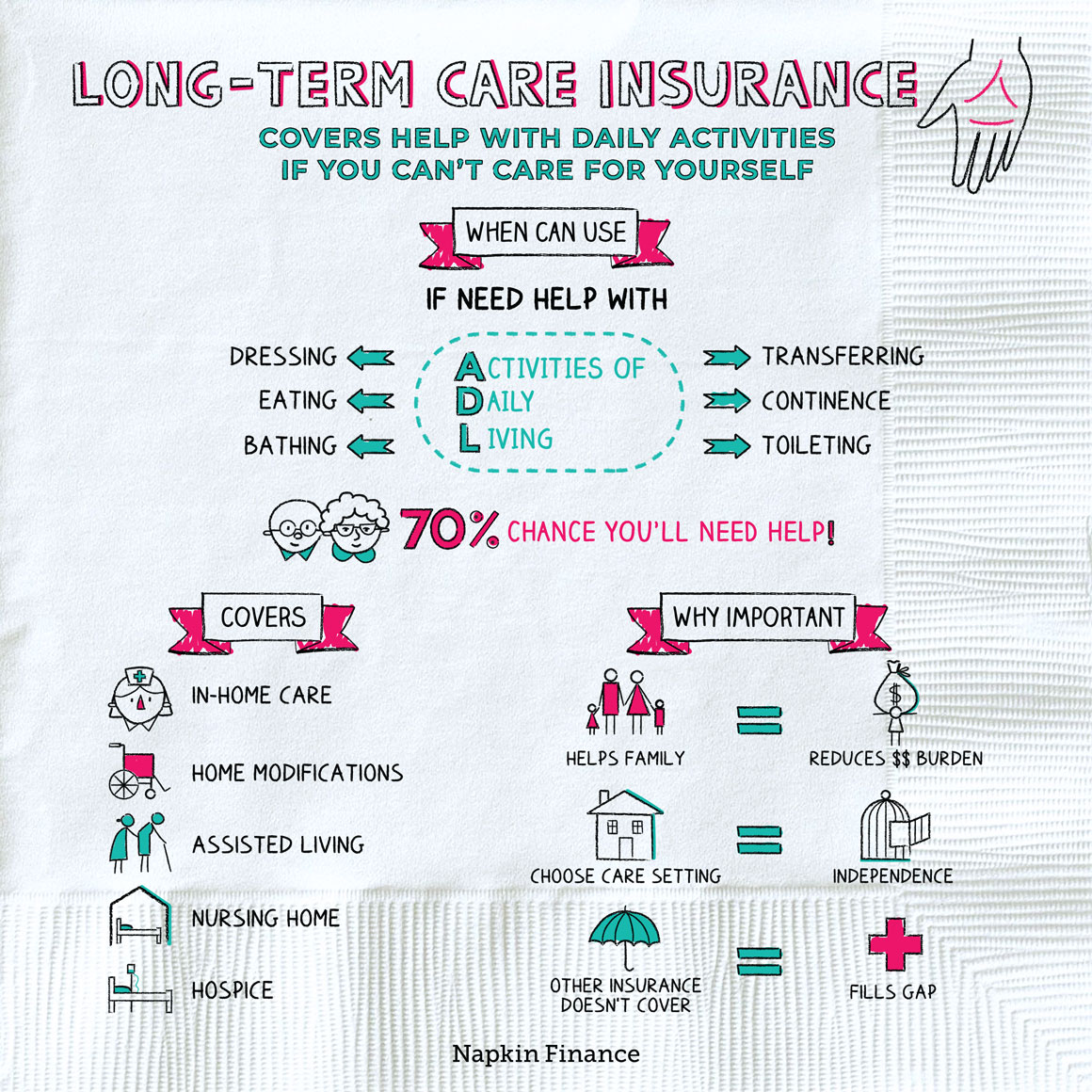

For example, a policy may offer $ per day up to five years of nursing home coverage (many policies now offer lifetime nursing home coverage) and only up to. This Shopper's Guide is one example of the NAIC's work to help states educate and protect consumers. Another way the NAIC helps state regulators is by giving. Long-term care (LTC) insurance is coverage that provides nursing-home care, home-health care, and personal or adult daycare for individuals age 65 or older. LONG-TERM CARE INSURANCE: MEDICARE AND MEDICAID. A BURDEN RELIEVED. Joe and Theresa Mollicone are a prime example of the benefits of private LTC insurance. Contrary to popular belief, traditional health insurance and Medicare usually provide little or no coverage for long-term care. Currently, most people who need. Some organizations contract with insurance companies to offer LTC insurance to employees, members and other eligible people. For example, such coverage is. This care may include help with daily activities, as well as home health care, adult daycare, nursing home care or care in a group living facility. Long–term. For example, if a long-term care policy provides a benefit of $ per day for care in an intermediate or skilled nursing facility, the policy must provide. The links below provide important information about long term care and the long term care insurance policies available in New York. For example, a policy may offer $ per day up to five years of nursing home coverage (many policies now offer lifetime nursing home coverage) and only up to. This Shopper's Guide is one example of the NAIC's work to help states educate and protect consumers. Another way the NAIC helps state regulators is by giving. Long-term care (LTC) insurance is coverage that provides nursing-home care, home-health care, and personal or adult daycare for individuals age 65 or older. LONG-TERM CARE INSURANCE: MEDICARE AND MEDICAID. A BURDEN RELIEVED. Joe and Theresa Mollicone are a prime example of the benefits of private LTC insurance. Contrary to popular belief, traditional health insurance and Medicare usually provide little or no coverage for long-term care. Currently, most people who need. Some organizations contract with insurance companies to offer LTC insurance to employees, members and other eligible people. For example, such coverage is. This care may include help with daily activities, as well as home health care, adult daycare, nursing home care or care in a group living facility. Long–term. For example, if a long-term care policy provides a benefit of $ per day for care in an intermediate or skilled nursing facility, the policy must provide. The links below provide important information about long term care and the long term care insurance policies available in New York.

Long-term-care (LTC) insurance can protect your assets so all of your lifelong savings don't go to a facility or home healthcare service. Long-term care insurance may be one option to cover services you might need if you are unable to care for yourself because of a prolonged illness or disability. This Shopper's Guide is one example of the NAIC's work to help the states educate and protect consumers. Another way the NAIC helps state insurance regulators. Indemnity benefits set a monthly benefit amount and will pay that full amount once you qualify for long-term care benefits. For example, if you buy $5, per. There are 4 different ways to pay for long-term care: government assistance; traditional long-term care insurance; "hybrid" insurance, which offers life. What Is Long-Term Care Insurance? · Mutual of Omaha · Thrivent · National Guardian Life · New York Life · Northwestern Mutual · Bankers Life6. Long-term care insurance helps protect employees retirement plans against the high cost of custodial care due to conditions such as Alzheimer's, strokes or. There is usually a daily, weekly, or monthly dollar limit for your covered long-term care expenses. For example, say you purchase a policy with a maximum. The company does not sell policies directly and there are many moving parts to their coverage. Thus, we recommend speaking to a knowledgeable LTC insurance. These are called “benefit triggers” and they vary by policy. For example, most policies will not provide coverage until you're unable to perform a given number. Long-term care insurance is designed to help pay for an individual's long-term care expenses. Depending on the plan you choose, it may pay part or all of. Long-term care insurance is designed to help pay for an individual's long-term care expenses. Depending on the plan you choose, it may pay part or all of. Long-term care insurance is designed to assist individuals with some or all of the costs of medical and personal care provided in the home. Long-term care insurance is one way to pay for long-term care. It is designed examples of how individuals have planned successfully for long-term care. Insurance policies covering long term care services contain maximums of from one to ten years, lifetime benefits, or a dollar amount limit. Some LTC policies only pay benefits for care in institutional settings such as nursing homes and assisted living facilities, while others only pay for home and. An LTC rider doesn't pay for expenses covered by health insurance policies like doctor visits, hospital stays, or prescriptions. If your insurer offers long-. Medicare and most other health insurance, including Medicare Supplement Insurance (Medigap), don't pay for long-term care. For example, assume your policy has a maximum benefit period of three years and you were in a nursing home for a year. If you don't need additional long-term. Long-term care insurance (LTC or LTCI) is an insurance product, sold in the United States, United Kingdom and Canada that helps pay for the costs associated.

What Is The Best Way To Refinance My Car

Yes, many lenders will allow you to refinance your existing car loan. Keep in mind that lenders may not offer refinancing as an option. Refinance Your Car · Auto loan refinancing is a great way to save money every month. · Get Pre-Qualified for an Auto Refinance Loan · Used Auto Loan Rates · Auto. How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. The best way to find out if we can refinance your vehicle is to get prequalified. We can refinance almost any vehicle, unless it: Is going to be used. Consider Your Options: Once you've gotten back different refinancing options from various lenders, explore your options to determine which one is right for your. Check Your Credit Score: Have you been diligent about paying your bills on time since purchasing your vehicle? · Start Applying: Apply to several automotive. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. Personal loan lenders are typically flexible in how you use the funds, while trading in your older vehicle can help you access a new car with better financing. Navy Federal Credit Union: Best for refinancing with military ties · Southeast Financial Credit Union: Best for accessing lowest refinancing rates · Gravity. Yes, many lenders will allow you to refinance your existing car loan. Keep in mind that lenders may not offer refinancing as an option. Refinance Your Car · Auto loan refinancing is a great way to save money every month. · Get Pre-Qualified for an Auto Refinance Loan · Used Auto Loan Rates · Auto. How to refinance a car loan in 5 steps · 1. Decide if refinancing makes sense for you · 2. Check your credit · 3. Gather relevant documents · 4. Ask the right. The best way to find out if we can refinance your vehicle is to get prequalified. We can refinance almost any vehicle, unless it: Is going to be used. Consider Your Options: Once you've gotten back different refinancing options from various lenders, explore your options to determine which one is right for your. Check Your Credit Score: Have you been diligent about paying your bills on time since purchasing your vehicle? · Start Applying: Apply to several automotive. If the interest rate you qualify for today is significantly lower than your current loan rate, it may be a good time to refinance a car. Personal loan lenders are typically flexible in how you use the funds, while trading in your older vehicle can help you access a new car with better financing. Navy Federal Credit Union: Best for refinancing with military ties · Southeast Financial Credit Union: Best for accessing lowest refinancing rates · Gravity.

So, if you're in the midst of applying for a mortgage loan, you may want to wait a while before refinancing your car — or you could do both through the same. If you want to change your loan term, or if you think you can get a better Annual Percentage Rate (APR) than before, refinancing might make sense for you. Read. If you didn't get your auto loan from CUTX, we won't hold it against you. However, there's a good chance you're paying too much. We're experts at finding ways. How LendingClub Bank Auto Refinancing Works · Check Your Rate. Tell us a little about yourself and your vehicle, and, if you qualify, you'll receive multiple. Steps to Refinance Your Car Loan · Review your current car loan · Know your car's value · Understand your credit and finances · Get quotes for refinancing rates. Start Applying For Auto Financing: Apply to several lenders to ensure that you get the best possible interest rate. Do your best to submit all applications. How Do You Refinance a Car Loan? · Check Your Credit Score: If your bills were all paid on time since your vehicle was purchased, there is a good chance your. If you're paying too much in interest for your car or truck loan, refinancing could be a great way to save some serious dough · The process is fairly simple. Refinance your car loan online in 3 easy steps ; Check your rate. Check your rate in minutes – without affecting your credit score.¹. Upstart Auto Refi Funding. Refinancing can reduce a monthly car payment that's too large for your budget. A lower payment can free up funds to pay off other, higher-rate debt. It can also. You can refinance your auto loan anytime. The sooner you refinance, the more money you'll save. That being said, if you need to work on your credit, it makes. The primary reason to consider refinancing is if you can qualify for a lower rate and will save money, either monthly or overall. Consider how long you have on. Should I refinance my car? There are some situations where it might be a good idea. One big example is if you think you can get lower interest rates or. If you want to change your loan term, or if you think you can get a better Annual Percentage Rate (APR) than before, refinancing might make sense for you. Read. Check Your Credit Score: Have you been diligent about paying your bills on time since purchasing your vehicle? · Start Applying: Apply to several automotive. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Apply Nowfor an auto refi loan. Today's Auto Refinance Loan. The best way to refinance an auto loan might vary between drivers and their unique circumstances, but a solid place to get started is to confirm your current. Four steps to a hassle-free refinance · Calculate the value of your car. · Prepare the necessary documents for your application. · Compare rates and fees, then. Refinancing is only beneficial when your new auto loan is somehow superior to the old one. So, it may make sense to refinance if something has happened that. Best Overall: PenFed PenFed Credit Union is our top auto loan refinance lender for a variety of reasons. Most lenders take at least a day to disburse your.

Ameritrade Maintenance Requirement

These requirements help protect both brokers and investors in the event that the stock tanks. Margin trading is typically riskier than trading with a cash. There is no minimum account balance to trade any Small Exchange product or CME outright future in a (non-IRA) margin account. However, you must have our. A house maintenance requirement is the level of minimum margin account equity that is required by a brokerage firm. There are two numbers calculated: Gross Maintenance Margin. This is what you have to keep in your brokerage account. - Net Margin Required. This is your net. The intercompany credit agreement with TD Ameritrade, Inc., the Company's introducing broker-dealer subsidiary, was established on March 31, and will. TD Ameritrade, Inc. is required to maintain minimum net capital of the greater of $, or 2% of aggregate debit balances. In addition, under the alternative. Pattern Day Traders have to maintain a minimum account balance of $25, in their margin accounts. This allows them to engage in unlimited day trading. Brokers. maintenance margin requirements of TD AMERITRADE's higher “house” requirements, TD AMERITRADE can sell the securities or other assets in any of your. Margin loans are NOT risk-free for both brokers. The maintenance margin requirement is 25% and a really bad day can blow right through it. These requirements help protect both brokers and investors in the event that the stock tanks. Margin trading is typically riskier than trading with a cash. There is no minimum account balance to trade any Small Exchange product or CME outright future in a (non-IRA) margin account. However, you must have our. A house maintenance requirement is the level of minimum margin account equity that is required by a brokerage firm. There are two numbers calculated: Gross Maintenance Margin. This is what you have to keep in your brokerage account. - Net Margin Required. This is your net. The intercompany credit agreement with TD Ameritrade, Inc., the Company's introducing broker-dealer subsidiary, was established on March 31, and will. TD Ameritrade, Inc. is required to maintain minimum net capital of the greater of $, or 2% of aggregate debit balances. In addition, under the alternative. Pattern Day Traders have to maintain a minimum account balance of $25, in their margin accounts. This allows them to engage in unlimited day trading. Brokers. maintenance margin requirements of TD AMERITRADE's higher “house” requirements, TD AMERITRADE can sell the securities or other assets in any of your. Margin loans are NOT risk-free for both brokers. The maintenance margin requirement is 25% and a really bad day can blow right through it.

Equities. + Margin requirement of the underlying(minimum 5%) NOTE: $10, equity required for uncovered equity writing. ; US Index. + 15% of the Broad Based. Be guided by your risk tolerance and only trade with funds you can afford to lose. Margin Requirements. When trading on. Ameritrade documents requiring a Trustee signature to an arrangement regarding the establishment and maintenance of SDBAs at TD Ameritrade Clearing. Until you add more funds to meet the minimum equity requirement, you will be limited to closing transactions only (sell orders) in your margin account. You will. This exposure causes the maintenance requirement to be held at the EPR percentage in the direction of risk, which is often higher than the base requirement. You always need to keep your portfolio above $2, and your margin maintenance requirement to avoid these types of margin calls. To view your margin. We may also hypothecate, which means we can pledge shares in your account as collateral for a loan at a bank. TD Ameritrade, Inc. reserves the right to. Furthermore, qualified portfolios must meet specific margin requirements. For example, the Regulation T margin requirement for new purchases is 50% of the total. If your $4, stock investment dropped in value to $3, for any reason, a broker with a 40% maintenance margin requirement would make a margin call and. Maintenance margin is lower than initial margin. Typically, the initial margin requirement will be % of the maintenance margin requirement. When traders. Securities With Increased Margin Requirements as of May 28th, The loan values of the following securities have been reduced. The following loan values. Day Trading Buying Power is given to margin accounts that have completed more than 3 day trades in a 5 rolling business day period, and have a start of day. Initial margin is the percentage of the purchase price of securities you must cover with your own funds when you first buy securities on margin. Maintenance. A Reg-T (RT) call is issued when a margin account makes a transaction that exceeds its available buying power. Generally, a Reg-T call is issued after an. Limited Margin IRA · $25, minimum account balance requirement · PDT rules apply if account falls below $25, · Available for Equities and Options (Level 2. You always need to keep your portfolio above $2, and your margin maintenance requirement to avoid these types of margin calls. To view your margin. This is the minimum required amount + margin that must be in the account before a buy order can be entered. Since 30% is the margin rate, TD Direct Investing is. The $10, borrowed from the brokerage represents the investor's margin balance. You can trade a variety of securities in a margin account, including stocks. margin requirements of TD Ameritrade's higher “house” requirements, TD Ameritrade can sell the securities or other assets in any of your accounts held at TD.